Don’t let negativity given to you by the world disempower you. Instead, give to yourself that which empowers you. – Les Brown Barbara Stanny, daughter of “R” in H&R Block, grew up relying on her father, then her husband to manage her money. But a personal crisis forced her to wake up and look at […]

What To Do With Bonus Money

For some lucky fellows, February may come in as bonus month. And some of these lucky ones might already be envisioning a vacation, a week of fun and entertainment, a house renovation, an iPad 4S or some other high-ticket item. While these are valid and acceptable ways to spend your bonus, my friendly advice is […]

Time Is Your Greatest Asset

Today, the question I have been trying to contend with the moment I woke up was, what am I supposed to write about now? I have a lot of ideas floating in this brain of mine. Problem is, how am I supposed to write them all given the limited amount of time I suddenly have […]

Recommended Financial Reading: Ang Pera Na Hindi Bitin

The whole family was at a National Book Store branch yesterday afternoon looking for materials the kids would need for their upcoming school projects when I came upon a book by Eduardo O. Roberto, Jr. – Ang Pera na Hindi Bitin [Money That’s Never Short]. I was with my daughter when I found it, and […]

Budget 101: Track Your Expenses

A few months back, I stopped tracking my expenses. Well, really, that should have been okay, because frankly speaking, it wasn’t at all something I intended to do for the long haul. I thought I was already financially astute enough to manage my expenses without the help of a pen and paper. Well, to my […]

Are You Financially Literate?

One way or another, we all have heard of them before – high-paying actors and actresses, world-renowned athletes surrounded by fame, adoration, not to mention, wads of cash during their heyday; practically unknown personalities laying down on beds of cash or drowning in pools of money from out of the blue, like a genie just […]

Budget 101: Assets vs. Liabilities

A fundamental skill to possess in order to lead a healthy financial life is to be able to spot the difference between assets and liabilities. Investopedia.com defines asset as “a resource with economic value that an individual, corporation or country owns or controls with the expectation that it will provide future benefit.” Conversely, it defines […]

Your Debt and Debt Consolidation

In previous posts, I’ve stressed again and again to always pay off your credit card debt in full and on time and to stay away from bad debt, credit card debt being one of them. But what happens when paying off credit card debt becomes a task so insurmountable? What are a debtor’s options? One of […]

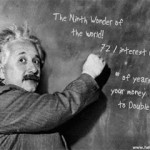

Investing 101: The Rule of 72

The Rule of 72 is a quick mental calculation, or a rough estimation, of the length of time, usually in years, for an amount to double given a fixed annual rate of interest. This is generally used for financial forecasts, especially in investments. This rule applies the law of compounding interest. To explain, compounding interest […]

Budget 101: Never Underestimate the Power of Small Beginnings

“Great things start from small beginnings.” I’ve heard that before, and you probably have, too. That actually is from a Milo jingle. And yes, there’s truth in that very line. In just about anything, the great started from the good, the good that was nurtured, painstakingly nourished to grow into something of considerable magnitude. Never […]

- « Previous Page

- 1

- …

- 7

- 8

- 9

- 10

- 11

- Next Page »